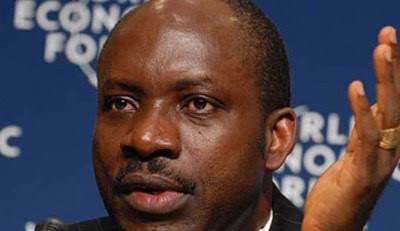

Jim Ovia, the Chairman of Zenith Bank (Nigeria) Plc, has reiterated the company’s commitment to delivering superior returns to its valuable shareholders in Nigeria.

Ovia gave the reassurance, as the Bank, at the weekend, began the payment of dividend to shareholders immediately after the approval of the proposal of the board to pay a final dividend of N2.45k per share to them as dividend for the 2017 financial year.

He was speaking in Abuja at he weekend where approval was unanimously given to the proposal at the 27th Annual General Meeting of the Bank. The approval of the N2.45k brings the total amount paid as dividend per share by the bank to N2.70k, following an interim dividend of 25k per share paid during the 2017 financial period.

Though Ovia, described the 2017 financial period as very challenging for operators in the banking industry, he declared that because shareholders constituted the biggest and very important stakeholders, the Bank shall continue to be committed to their cause by delivering to them superior returns on their Investment in the industry in Nigeria.

His words: “The Bank remains committed to delivering superior returns to our valuable shareholders. In clear demonstration of this, we had declared and paid you an interim dividend of 25 kobo in the cause of the 2017 financial year. We hereby propose a final dividend of 245 kobo per share, if approved this will bring the total dividend for the year ended December 2017 to 2.70 kobo per share against 2.02 kobo per share that was paid the previous year.”

Addressing them further on the results of the year under review he informed that the bank, total deposits were N2.74 trillion in 2017, representing an increase of eight per cent over the previous year’s figure of N2.55 trillion; profit before tax rose by 24 per cent from N140 billion in 2016 to N174 billion in 2017, while total assets of the bank grew by 13 per cent from N4.28trillion in 2016 to N4.83tn in 2017, adding that shareholders’ funds rose by 15 per cent from N616 billion in 2016 to N708bn; gross earnings also grew by 48 per cent from N455 billion in 2016 to N674 billion in the year under review.

He described the impressive financial results as a testament to the durability and resilience of the Zenith Bank brand.He said, “The year 2017 was no doubt a very challenging year for operators in the banking industry due to a number of domestic and external factors. However, true to our track record, Zenith Bank was able to fully exploit the opportunities within the environment.

“This translated into an excellent performance that stands as a testament to the durability and resilience of the brand. Clearly, the results are once again a reflection of the exceptional financial health of the bank and the group.”